Most Houston home insurance policies will cover the rebuilding cost of your home if it’s completely destroyed. However, you need to insure your home at least 80% of the rebuilding cost. First, you will need to determine the cost to reconstruct your home. An insurance broker will determine the estimate for you using several programs and factors, but you can make a calculation on your own of your home’s rebuilding cost.

Most Houston home insurance policies will cover the rebuilding cost of your home if it’s completely destroyed. However, you need to insure your home at least 80% of the rebuilding cost. First, you will need to determine the cost to reconstruct your home. An insurance broker will determine the estimate for you using several programs and factors, but you can make a calculation on your own of your home’s rebuilding cost.

Research the average reconstruction costs instead of the purchase or sales price of your home. A lot of consumers are amazed when they purchase a home for $200,000 and their agent plans to insure it for $400,000 or more. This means that the cost of replacing a home is greater than the cost of purchasing another similar home. This is due to the fact that to replace a home, contractors are typically required to remove the debris from a claim (storm, fire), then reconstruct a new home similar to the style and size of the damaged home.

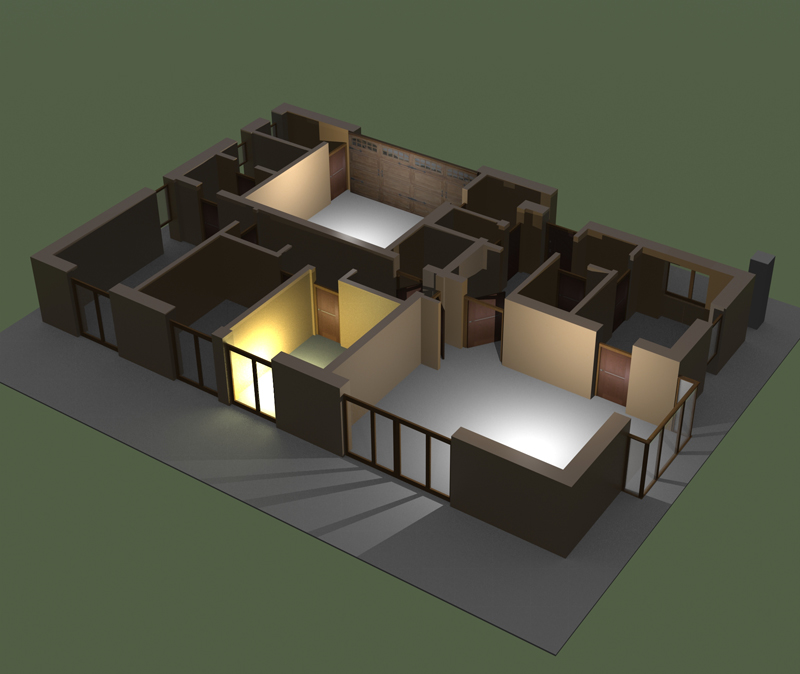

Make a list of the important details of your home. These details should include the total size of your home (in square feet), its quality, number of stories, kitchens, bathrooms, and other important features such as the garage and deck. Your county inspector may have an online database that lists the specifics about your home.

Contact your contractors and ask an estimate. Remember, the costs of rebuilding a home are typically based on the costs of debris removal, labor and materials. New construction in your area may range from $90 to $100 for every square foot. However, if you include the costs of debris removal from wind, water or fire damage, the rebuilding cost will increase. Many contractors nowadays can help you with the estimation as they specialize in insurance work. When estimating the replacement cost, bear in mind that you are replacing the exact feature of your home. Hence, older homes with large windows, nine-foot ceilings and thick wood trim may cost more to replace.

Assess the location of your home. You should be aware that many insurance providers use special mechanized models or programs that calculate building costs. This is typically done by zip code or other geographic marker. Also, think about the demand for construction work and associated fees in your area. For instance, the average reconstruction costs for mid-century ranch in suburbs Ohio may be $80 to $90 per square foot, while the price to reconstruct a condo in Manhattan may be $400 per square foot.

If you want to know more information on how to calculate home insurance rebuilding costs, call a Henrich Insurance Group agent today at 877-349-0200. We will be very happy to help you get the right estimation.